John Bogle, the longtime champion of low-cost investing and founder of the Vanguard Group, is not one to rest on his laurels.

You would think that the recent Department of Labor “clients first” fiduciary standard ruling — earned after decades of fighting an investment industry focused on profits over people — would qualify as a big win.

Don’t get me wrong, it is a big win. Millions of American retirement investors will save billions of dollars each year in unnecessary fees and commissions. Putting clients first, a seemingly logical choice, is now the law.

Yet Bogle is taking it a step further, telling an audience in Philadelphia this week that the government now should extend those safeguards to all investors, retirement-oriented or not.

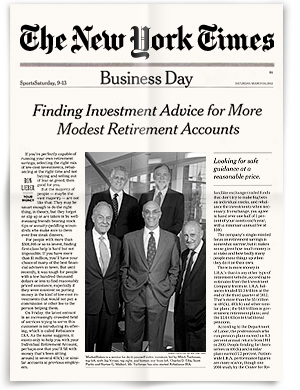

My partner Scott Puritz, a Managing Director at my firm, Rebalance, joined Bogle, former SEC Commissioner Luis Aguilar and Phyllis Borzi, the Assistant Secretary of the Department of Labor, at an event celebrating the fiduciary standard ruling. They were guests of the Institute for the Fiduciary Standard at the National Constitution Center, where Bogle spoke.

In his address, Bogle called on the Securities and Exchange Commission, which regulates the investment industry, to extend the Department of Labor fiduciary rule to all investors and to anyone who “even touches” client money — not just financial advisors.

As he points out, it’s not as if a fiduciary duty is something utterly new. Registered Investment Advisors, known as RIAs, have followed the fiduciary standard for decades.

It’s time for the SEC to bring the entire industry along, Bogle said. “I think it’s fair to say we’re at the beginning of an arc of finance that is bending toward fiduciary duty,” he said at the launch event for the Campaign for Investors, sponsored by the Institute for the Fiduciary Standard.

Stockbrokers who oversee retirement investments, Bogle charged, now face a real dilemma.

For instance, a stockbroker with both retirement investors and “standard” non-retirement investor clients must explain why he should act in the best interest of one group of clients but not necessarily the other.

Absent a clear rule from the SEC on fiduciary duty, stockbrokers are left to wonder if non-retirement investors are subject to a lower standard of care, Bogle pointed out. A stockbroker reasonably asks, “Do I have two sets of clients, one over here and one over there? Be careful here, but the sky’s the limit over there?” Bogle mused.

“It seems unbelievable, and it is unbelievable. As a practical matter, I cannot imagine brokers serving their non-retirement plan clients with a lower standard of care than their retirement plan clients. And how could they defend such an action? It would indefensible,” he said.

Clients first, for all

Bogle went on, “I expect the system to move quickly to the all-encompassing application of a fiduciary standard. That issue would be far better resolved if the SEC stood up to the plate and took parallel action to establish a DOL-type fiduciary duty standard for all clients of retail intermediaries.”

By “intermediaries,” Bogle truly means everyone involved in the investing business. “The standard must be applied to every person and every entity that even touches client money,” he said. That includes institutional money managers, who control 70% of stocks. Officers, directors, trustees, custodians, even certain marketing officials, Bogle said.

“The extension of the fiduciary standard will be a long battle, but it is a battle we will win,” Bogle predicted.

Yes, Bogle is thinking long-term, but he has always been that way, starting with the first index funds introduced by Vanguard in the mid-1970s and even dating back to his Princeton thesis more than two decades before that.

As we learn from Bogle’s career, perseverance pays, then and now.