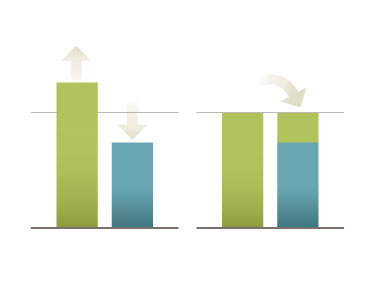

One of the more mysterious aspects of portfolio management is effective rebalancing. Simply put, it is the disciplined practice of selling investments that have risen in value while buying more of those that have declined.

Imagine that you own a portfolio that holds 60% stocks and 40% bonds. Naturally, you check on it periodically. If your stock position has increased in value and now represents 64% of your investment value, you would sell off the excess and buy bonds with the resulting cash.

The target is to return to your 60/40 split and, one hopes, to forget about it for a while. A more sophisticated portfolio would own six to eight investment types and might even rebalance between the individual funds inside each asset class.

Nevertheless, the strategy is the same: To realize timely gains and buy what is on sale.

Rebalancing is mysterious because it can be hard to know when to rebalance. Lacking clear direction, many investors fall into the pattern recommended by financial advisers and investing pundits: “Oh, do it on your birthday” or “No more than twice a year.”

Of course, you could rebalance every single trading day. It is technically possible, although clearly a bad idea. The trading commissions alone would overwhelm any potential advantage. Costs are a killer.

The answer, then, is “somewhere between daily and annually.” Far from useful advice.

Most big, state-run pension funds, for instance, rebalance on a calendar. They move money around in your accounts to get back to balance on the 90th day of each quarter without fail.

They do this because it is a simple, defensible and, for them, likely an effective policy. It also is cheap, if you happen to run a big pension fund. Often, the pension manager is using funds owned by his or her own firm, so the trading costs are zero. The bid-ask spread — the gap between the price you expect to get for a security and what actually happens on the open market — also is nil.

It is like a rancher moving cattle from one pen to another. At the end of the day, all the cows are still on the same ranch. Why not move them to a spot where the grass is a bit fresher?

For retail investors, however, this idea is a non-starter. Trading using low-cost exchange-traded funds (ETFs) and index funds is a help, but not every fund is commission-free. The bid-ask spread is quite narrow for large, in-demand ETFs, but it is not zero. The friction of trading costs is low but not gone.

Effective rebalancing for retirement investors

So, the strategy for the effective retirement investor is to set targets. For a given investment type, say, a large U.S. stock fund, rebalancing occurs only when it strays beyond a given percentage either way. For a bond fund, this percentage band might be less forgiving. For a volatile emerging markets ETF, you might assume more room to move.

The size of your investment positions plays a role. A small-balance account might generate more in costs than the potential reward. A large account might need narrower bands to be effective.

In any case, the target outcome — always — is to reduce risk and seek a reward for agile, thoughtful management. A premium from rebalancing is never a guarantee, but it nearly always cuts needless risk and often opens the door to otherwise forgone gains.

In a nutshell, that is how Rebalance works. Interestingly, Professor Burton Malkiel, the Princeton University senior economist and author of the investment classic A Random Walk Down Wall Street, found that the premium from rebalancing alone is substantial — an extra 1.5% over the stock market in the last 15 years.

Low costs, high discipline, simple investments. Put those three ingredients together and the results are, in a word, impressive.